Who Would Pay More if the Social Security Payroll Tax Cap Were Raised or Scrapped? - Center for Economic and Policy Research

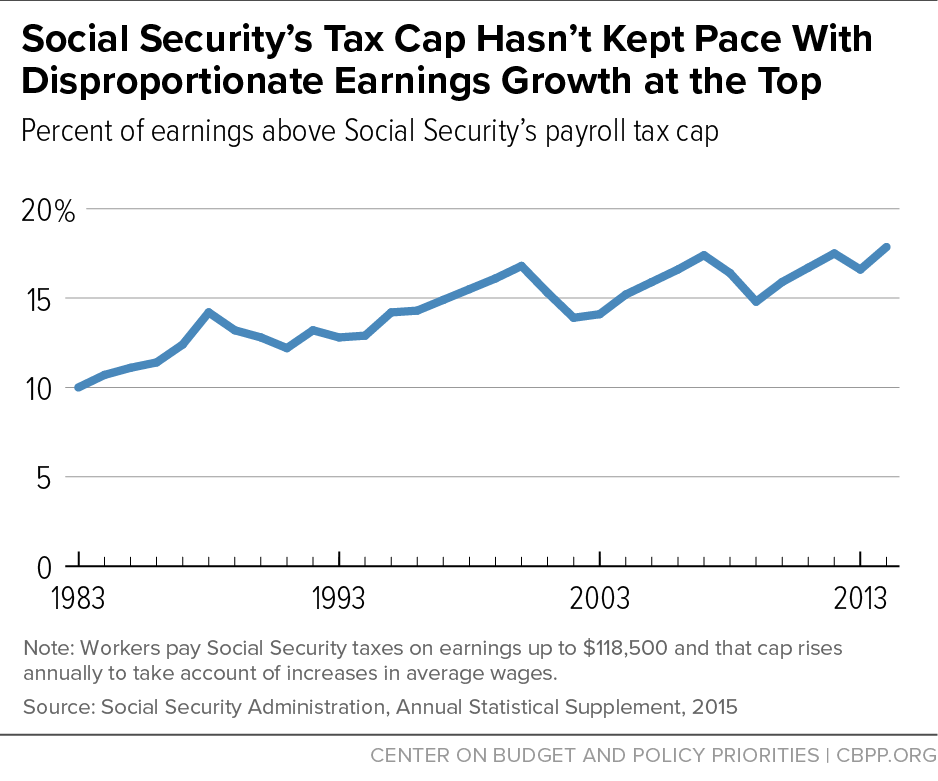

Removing the Social Security earnings cap virtually eliminates funding gap | Economic Policy Institute

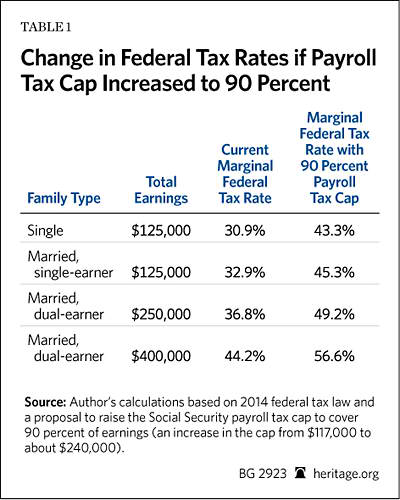

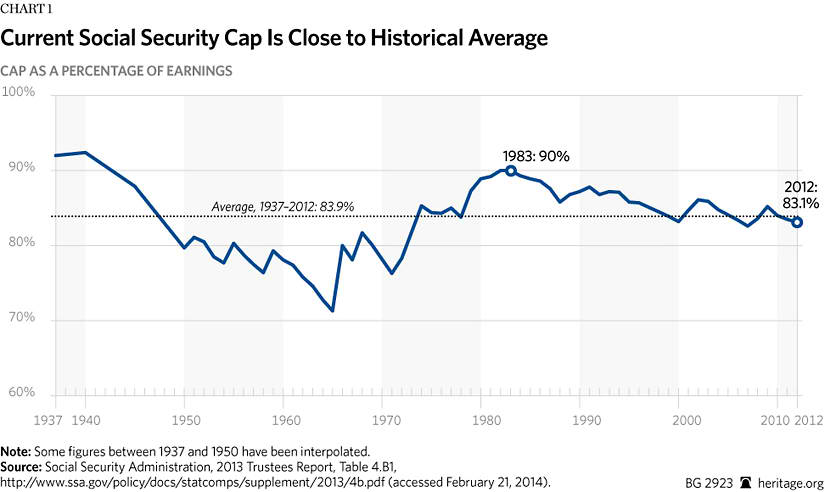

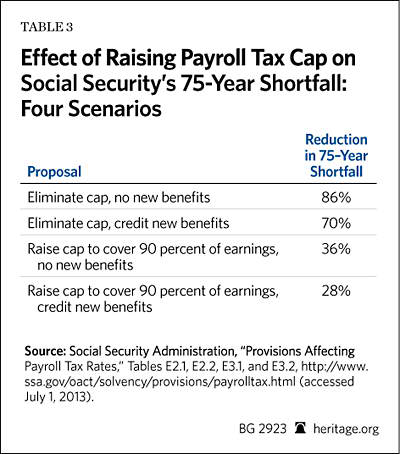

Raising the Social Security Payroll Tax Cap: Solving Nothing, Harming Much | The Heritage Foundation

Raising the Social Security Payroll Tax Cap: Solving Nothing, Harming Much | The Heritage Foundation

:max_bytes(150000):strip_icc()/iStock_92129291_MEDIUM.social.security.bldg-e5e3b3bde3db445ab7edf3bb24fd255a.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1168040761-5ae0caa8adf64faa960c2e4964ca1333.jpg)